tax on unrealized gains bill

Ten Reasons to be Concerned with Bidens 20 Percent Tax on Unrealized Gains 1. Billionaires and their growing piles of.

Taxing Unrealized Capital Gains A Bad Idea National Review

The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains.

. The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. Taxes Taxes Taxes It has already been a long year of new taxes tax hikes and even more tax proposals. Sebelius 2012 the court reaffirmed that taxes on personal property are direct taxes.

President Bidens 2 trillion spending package continues to stall as senior Democrats are hoping to finalize a proposal on a new annual tax. A newly proposed annual tax on unrealized investment gains has been floated as a way to pay for the new 35T infrastructure bill. The Tax would Empower The IRS In order to enforce this tax the IRS would have to be given vast new powers to value.

March 26 2022 229 PM PDT. Global asks Democrats are trying to pass a bill to tax unrealized capital gains on a yearly basis. Democratic leadership over the weekend began suggesting a new way to pay for President Bidens multitrillion-dollar social policy and climate action spending bill a tax on wealthy peoples unrealized capital gains.

If it passes what is the point in investing in the. The Tax Would Likely Grow to Hit Millions of Americans Over Time The tax would apply to taxpayers. Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the sum total of their unrealized gains.

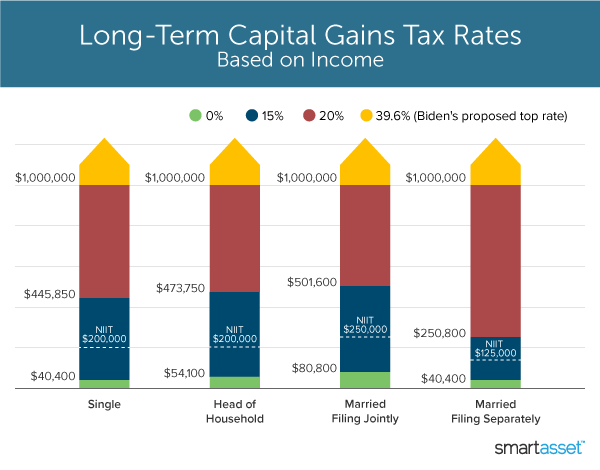

The amount of the credited prepayment would be calculated as the minimum tax payment at the 20 tax rate reduced by unrefunded uncredited prepayments and regular income tax. It excludes tax owned. Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent.

A proposed House Ways and Means bill suggests raising capital gains tax rates to a maximum of 28 percent still lower than the top rate for income tax. October 25 2021. President Biden on Monday unveiled a new minimum tax targeting billionaires as part of his 2023 budget request proposing a 20 rate that would hit both the income and unrealized capital gains of.

The speaker of the House of Representatives who is reportedly the sixth-wealthiest member of Congress at over 100 million took issue late last month with plans by fellow Democrats to levy a. A tax on unrealized capital gains would be a direct tax because its a tax on personal property paid by. Under the proposal the wealthiest Americans would be required to pay a tax rate of at least 20 on their full income or the combination of wage income and whatever they made in unrealized gains.

Unrealized capital gains are increases in value of stock purchases. High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains.

When the wealthiest families incur income taxes on capital gains they pay a top 238 federal tax rate on the transaction lower than the top 37 rate on income like wages. Currently taxpayers pay tax only on realized capital gains in. Sarah SilbigerBloomberg via Getty Images.

At tax time I keep having to pay the governemnt for all the unrealized capital gains that occur as a result of trading within the mutual fund. With their latest tax proposal Democrats are going after an elusive target. The tax would apply to people who make more than US 100 million a year for three years in a row or if one makes US 1 billion in annual income.

How might it change the best investment strategies. October 26 2021 619 AM PDT. President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US.

So foolishly I invested in several mutual funds in my non-retirement accounts. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022.

The impacted assets include stocks bonds real estate and art. According to The Wall Street Journal. I want to move my money over to less actively.

Tax owned only includes taxes on the existing stock of unrealized gains. Getting crushed on taxes on unrealized cap gains on mutual funds. 24 2021 126 pm ET 1150 Listen to article 2 minutes WASHINGTONA new annual tax on billionaires unrealized capital gains is likely to be included to help pay for the vast social policy and.

Households worth more than 100 million as.

The Coming Tax On Unrealized Capital Gains

Crypto Tax Unrealized Gains Explained Koinly

Crypto Tax Unrealized Gains Explained Koinly

High Class Problem Large Realized Capital Gains Montag Wealth

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

Bitcoin Gains Can Become Tax Free Investing In Cryptocurrency Cryptocurrency Bitcoin

Biden S Better Plan To Tax The Rich Wsj

Stop Worrying About The Unrealized Gains Tax Are You Insanely Wealthy Already No Cool Then It Doesn T Apply To You It S Fud Billionaire Fud R Superstonk

What Is Unrealized Gain Or Loss And Is It Taxed Gobankingrates

The Unintended Consequences Of Taxing Unrealized Capital Gains

Here It Is Wyden S Unrealized Capital Gains Tax On Wealthy Americans Swfi

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

What S In Biden S Capital Gains Tax Plan Smartasset

Crypto Tax Unrealized Gains Explained Koinly

Build Back Better Legislation Tax On Unrealized Capital Gains Does Not Pass The Fairness Test Ethics Sage

Unrealized Gains And Loses Example Of Unrealized Gains And Losses

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times